For advice technology to be truly beneficial for a practice or licensee, compliance needs to be a key ingredient in its recipe, says Midwinter’s Ekta Desai.

Compliance is a contradiction.

It’s central to business success but is often a drain on business productivity. It is intended to improve client outcomes, but often just adds to their costs. It grabs plenty of headlines, but for all the wrong reasons.

And for financial advisers, compliance remains their top concern. Even when COVID-19 swept the world in April 2020, more than two-thirds (68%) of planners cited compliance as their top challenge followed by disruption from COVID-19 (59%), according to research by Investment Trends.

Advice technology needs to do more of the heavy compliance lifting for advisers so they can concentrate on higher value-adding tasks. Yet technology can only be effective when compliance is baked in from the outset, rather than sprinkled on as an afterthought.

Seamless processes stop compliance breaches

Many compliance issues are not the result of poor advice – they’re caused by process failure. It’s impossible to manage the rising regulatory load relying on manual ways of working, given an individual adviser serves between 100-200 clients on average.

Yet only five years ago, ASIC found monitoring compliance in large institutions was being held back by paper-based record keeping that made information difficult to access, as well as legacy IT systems and other issues.

More recently, ASIC found that more than half of licensees lacked effective processes to remind them when fee renewal notices were due or to turn off ongoing fees.

These are basic requirements that suggest technology providers are not looking close enough at advisers’ compliance needs and creating embedded, intuitive solutions.

Meeting the challenge begins at a holistic level: an advice technology platform should be built around a client’s goals rather than products. Then, consider the practical questions. Compliance should also be reflected at the micro level: are advice dashboards intuitive and customisable? Can client documents be sent easily and tracked through an online portal?

As an example, Midwinter’s Product Comparison module within the AdviceOS platform is not a compliance tool, but compliance was built into this feature as a core requirement, not an afterthought.

The module provides both product comparisons and projections, allowing advisers to quickly map an approved product list (APL) and perform like-for-like product comparisons across multiple platforms based on a client’s personal needs.

This allows advisers to show clients that they are acting in their best interests by comparing multiple products across a wide range of parameters.

Advice technology should automatically pick up genuine breaches

Australia was one of the first countries to make seatbelts compulsory in 1971. The technology quickly became standard, and most people learned to put their seatbelts on without even thinking about it.

However, even the best safety systems and processes have exceptions: each year about 30 drivers and passengers are killed and 220 injured who were not wearing available seatbelts4.

The stakes may not be that high in the advice industry, but when things go wrong, technology needs to provide a straightforward way to identify and correct compliance failures.

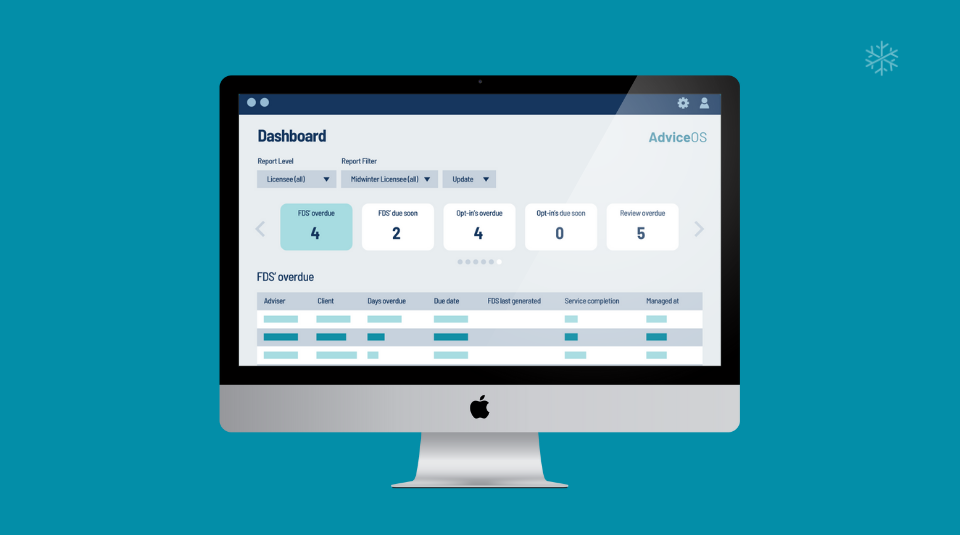

The Key Risk Indicator Solution (KRIS) solution in Midwinter’s AdviceOS is one example: a simple dashboard reveals any upcoming or overdue opt-in renewal notices and annual fee disclosure statements. It also helps monitor risks such as products recommended from outside the APL, and RoA vs SoA ratios.

This type of embedded process enhances compliance and efficiency – one mid-sized dealer group recently estimated it saved the average individual adviser about four to six hours a week.

No workflow can ignore compliance, but that doesn’t mean it should weigh down efficiency. The right type of technology can embed compliance so that advisers can get on with the job of providing great advice.

Ekta Desai is a Business Development Manager at Midwinter Financial Services. Click here for more information about Midwinter’s AdviceOS or contact Ekta and the team on [email protected].